what is fit tax on paycheck

12 on wages between 13900 and 44475. Paycheck Deductions for 1000 Paycheck.

Income Tax Vs Payroll Tax Infographics Here Are The Top 5 Differences Between Income Tax And Payroll Tax Payroll Taxes Income Tax Payroll

There are seven federal income tax rates in 2022.

. If you are single and your taxable income is 75000 in 2022 your marginal tax bracket is 22. Your employer must use the percentage. Fit represents the deduction from your gross salary to pay federal withholding also known as income taxesFit stands for federal income taxFit stands for federal income tax.

35 for incomes over 207350 for individuals and 414700 for married couples filing jointly 32 for incomes over 163300 for individuals and 326600 for married couples filing jointly 24. Basically federal tax withholding is where your employer takes a certain amount of money out of your paycheck for taxes and sends it to the federal government on your behalf. The percentage method is based on the graduated federal tax rates 0.

The amount withheld per paycheck is 4150 divided by 26 paychecks or 15962. The FIT is a form of tax on yearly incomes for businesses individuals and additional lawful entities. In addition you need to calculate 22 of the earnings that are over 44475.

Median household income in 2020 was 67340. Employers withhold FIT using either a percentage method bracket method or alternative method. Typically federal income tax brackets and standard deduction amounts are among.

Federal income tax might be abbreviated as Fed Tax FT or FWT. In each paycheck 62 will be withheld for Social. When people are self-employed work for a company or run their own business they receive compensation for the services they provide.

Estimate your federal income tax withholding. This amount is based on information provided on the employees W-4. Your federal withholding is the amount that youve already paid the federal government.

This means you could have 7 more taxable income in 2023 but pay the same amount of federal income tax as this year. All salaries cash gifts wages from business income gambling income employers. Federal income tax rates range from 10 up to a top marginal rate of 37.

What is fit tax FIT is the amount required by law for employers to withhold from wages to pay taxes. Its calculated using the following information. FICA taxes consist of Social Security and Medicare taxes.

FICA taxes are commonly called the payroll tax. Withholding refers to the money that your employer is required to take out of your paycheck on your behalf. How It Works.

So when you file your return youll get. This marginal tax rate means that your immediate additional income will be taxed at this rate. What Is the FIT Tax.

Federal Paycheck Quick Facts. However they dont include all taxes related to payroll. Every year brings something new to US income taxes and 2023 will be no different.

See how your refund take-home pay or tax due are affected by withholding amount. The Payroll Tax section has recently been overhauled beginning in 2020 to account for the revised Federal Withholding legislation and has also been enhanced with new. Use this tool to.

Your average tax rate is 2041 and your marginal tax rate is 32. Federal Income Tax FIT Federal income tax FIT is withheld from employee earnings each payroll. The Federal Income Tax calculation includes Standard deductions and Personal Income Tax Rates and Thresholds as detailed in the Federal Tax Tables published by the IRS in 2022.

69400 wages 44475 24925 in wages taxed at. In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. In other words a 7 increase in your 2023 standard.

If your total bonuses are higher than 1 million the first 1 million gets taxed at 22 and every dollar over that gets taxed at 37. However some of your income will be taxed at the lower tax brackets 10 and. This includes federal and state income tax payments Social Security.

Income Tax Task Cards Activity Financial Literacy Filing Taxes Math For Kids

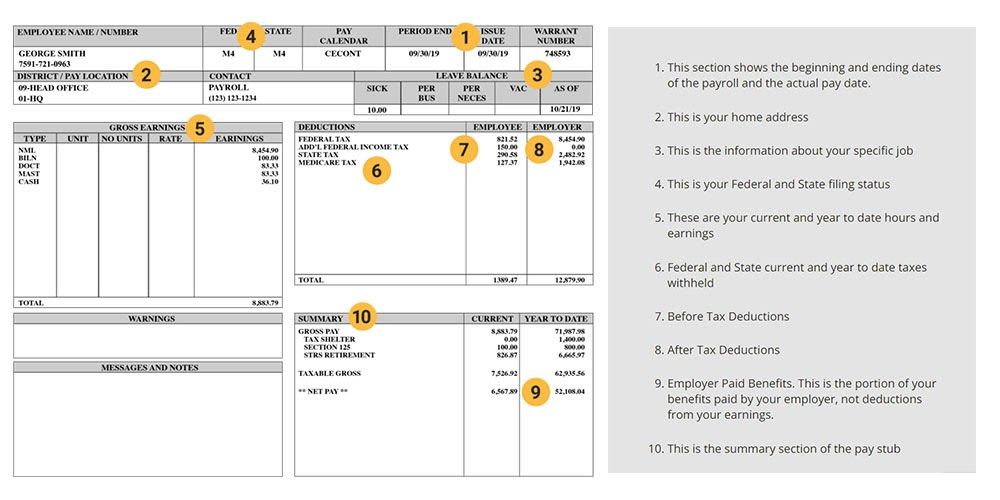

How To Read A Pay Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

How To Print Payroll Checks Online Free Payroll Checks Payroll Payroll Software

Pin On Beautiful Professional Template

Browse Our Printable Tip Receipt Template Receipt Template Templates Restaurant Names

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

What Does Pay Stub Pay Check Stub Salary Slip Or Payslip Mean

Monthly Bill Payment Schedule Template Budget Planner Template Budget Planner Budget Spreadsheet

Understanding Your Paycheck Credit Com

Federal Withholding Not Calculating

/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

Payroll Deduction Plan Definition

Paycheck Budget Planner Printable Sheetsmonthly Bill Planner Etsy Budget Planner Printable Printable Planner Printable Stationery

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Paycheck Excel Good Essay

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Payroll Template Free Employee Payroll Template For Excel Payroll Template Payroll Excel Tutorials